Why is ethereum tanking network fee average bitcoin

Share Tweet. All Rights Reserved. As more ETH equates to more token usage; the two charts are evident of user behavior. To put it simply, the higher mining revenues, the more energy-hungry machines can be supported. Prev Next. Montana State makes a move in favor of crypto-space as the law recognizes utility tokens as not securities. The Bitcoin Energy Consumption Index was created to provide btc mining rental cloud data mining into this amount, and raise awareness on the unsustainability of the proof-of-work algorithm. For updates and exclusive offers enter your email. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general btm crypto jaxx with existing wallet topics of. As for Stellar, its Lumens coin has been acting as an intermediary currency on IBM 's blockchain network in the South Pacific in order to expedite transactions. Bitcoin Consumes A Lot. I consent to my submitted data being collected and stored. Burton took out a CDP to pay salaries at his startup. Since their departure, the mainstream bitcoin network has been controlled by bitcoin's "small block" faction. Connect with us. Montana also made headlines because of news pertaining to cryptocurrency mining regulation. News Weiss Ratings: You must be logged in to post a comment.

Bitcoin (BTC) Hash Rate Drop 22 Percent in Four Days, Shifting Sentiment?

In Bitcoin company Coinshares did suggest that the majority of Chinese mining facilities were located in Sichuan, using cheap hydropower for mining Bitcoin. Post-mining his first bitcoins inxrp to bitcoin where to buy bitcoin usb was no looking back for Shaurya Malwa. According to their own estimates, all cryptocurrency mining facilities for the top-6 cryptocurrencies were running on 5. That's a pretty good summary of why investing in digital tokens is a risky bet. Considering that EOS has no transaction fees, it'll be interesting to see just how successful it is in pulling crypto investors away from Ethereum and other competing digital coins. A hard-coded limit on the size of blocks limits how many transactions the bitcoin network can process per second. The impact of these fee increases could have far-reaching effects on several alerts relative prices of bitcoin how do i do a limit order on coinbase already leveraging the popular stablecoin for in-house operations. Further increases will require more radical changes. We use cookies to give you the best online experience. In their second study, Rauchs et al. On the other hand, if the bitcoin bubble continues to deflate, fees are likely to remain reasonable. It could dramatically expand the bitcoin network's capacity by shifting most routine transactions outside the blockchain. Crypto App Download. Lightning will be a good fit for some bitcoin applications and a poor fit for others—it remains to be seen how much of the bitcoin community will ultimately switch from old-fashioned bitcoin transactions to new-fangled Lightning ones. But unlike bitcoin, Litecoin, and other medium-of-exchange tokens, the XRP token has virtually no utility when it comes to buying goods and services. Timothy B. Given that the fees mirror the price of the coin, average transaction fees began to pump in early April when Bitcoin saw its largest daily gain in gold bitcoin value how to earn bitcoins passively a year.

Oct 8 at 7: But the methodology underlying the Bitcoin Energy Consumption Index has been recognised in peer-reviewed academic literature since May the full paper can be found here. The trick is to get all miners to agree on the same history of transactions. Popular Stocks. Of course, these numbers are far from perfect e. Leave a Reply Cancel reply You must be logged in to post a comment. This effectively packs more payments into less space on the blockchain. Meanwhile bitcoin's greatest competitor on the medium-of-exchange front, Litecoin, fares a little better with an average processing time of 30 minutes. Apply For a Job What position are you applying for? That should give the bitcoin world a bit of breathing room. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Share Tweet.

New Data Shows Users ‘Overpay’ as Bitcoin Fees Lower Than Wallets Suggest

News Review: To a large extent, high fees became a problem that solved. If Bitcoin was a country, it would rank as shown early notification of new coins on bittrex etfs holding bitcoin. Related posts NEWS. Today, we'll take a look at how those average transaction speeds compare among the 15 largest cryptocurrencies by market cap, according to CoinMarketCap. Rule Breakers High-growth stocks. But it is not only profitability where Bitcoin seems to be outperforming peers. In plainer terms, it's a brand-new way to transmit money, and a unique way to log data in an unchanging manner. Being the most popular digital coin in the world, bitcoin's network might also be suffering from its inherent popularity. From what is publicly available, miners are back to green. The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency. Sure, seeing a digital coin gain acceptance could cause its price to rise as emotional investors pile in. Connect with us. Indeed, Lightning is a bigger change than Segregated Witness, so we can expect the shift to take longer.

Probably the most noteworthy aspect of this data is that the kingpin of all digital currencies, bitcoin, has the slowest average processing time of the bunch. Just last month, the network saw faltering transaction rates and the drop of a yearly-low of ,, reported Trustnodes on Oct. In plainer terms, it's a brand-new way to transmit money, and a unique way to log data in an unchanging manner. Why return It doesn't mean any extra profit or revenue for developers. In Bitcoin company Coinshares did suggest that the majority of Chinese mining facilities were located in Sichuan, using cheap hydropower for mining Bitcoin. At the heart of this rally has been the emergence of blockchain technology. On Oct. May 23, at 9: This is nowhere near the emission factor of a grid like the one in Sweden, which is really fuelled mostly by nuclear and hydroelectric power.

Bitcoin’s transaction fee crisis is over—for now

Once one of the miners finally manages to produce a valid block, bitcoin cash use cases bitcoin dude will inform the rest of the network. In the worst case scenario, the presence of Bitcoin miners may thus provide an incentive for the construction of new coal-based power plants, or as already happened reopening existing ones. Buying and trading cryptocurrencies should be considered a high-risk activity. Bitcoin News Crypto Analysis. May 23, at 9: Bitcoin Bitcoin Cash news Transaction Fees. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Every miner in the network is constantly tasked with preparing the next batch of transactions for the blockchain. DAI user habits. Bitcoin hashrate is exploding. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs. Note that the Index contains the aggregate of Bitcoin and Bitcoin Cash other forks of the Bitcoin network are not included.

Criticism and potential validation of the estimate is discussed here. One can argue that specific locations in these countries offer less carbon intense power, but unfortunately, this is the most granular level of information available. The most detailed available report on cryptocurrency mining facilties is this study by Garrick Hileman and Michel Rauchs from These signatures aren't counted against that one-megabyte block-size limit, so this is a de facto block-size increase. Share Tweet Send Share. Sure, seeing a digital coin gain acceptance could cause its price to rise as emotional investors pile in. At press time, popular Bitcoin wallet Blockchain. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. This effectively packs more payments into less space on the blockchain. Further increases will require more radical changes.

Increasing Interest

Aakash Athawasya. Article Info. In proof-of-stake coin owners create blocks rather than miners, thus not requiring power hungry machines that produce as many hashes per second as possible. The table below features a breakdown of the energy consumption of the mining facilities surveyed by Hileman and Rauchs. Follow us on Telegram Twitter Facebook. The paper also predicted that this level would be reached towards the end of Your email address will not be published. Price wise, Bitcoin is the top performing asset in the top The spokesperson added that people who hold MKR tokens are the only ones with the power to vote to add or remove data sources. Ethereum ETH Updated: Bitcoin is Unsustainable. Stock Advisor Flagship service. May 23, at 9: To a large extent, high fees became a problem that solved itself. While average transaction speed does provide what appears to be a useful tool to prospective cryptocurrency investors, ultimately, it tells us almost nothing about whether a digital token has long-term staying power, which is what really matters. But it is not only profitability where Bitcoin seems to be outperforming peers. For those unfamiliar, blockchain is the digital, distributed, and decentralized ledger that underlies virtual tokens and is responsible for recording transactions without the need for a financial intermediary, such as a bank. Critics have meanwhile warned that rock-bottom fees will not go on indefinitely, despite progress on alternatives to on-chain transactions such as the Lightning Network making rapid progress. Montana State makes a move in favor of crypto-space as the law recognizes utility tokens as not securities.

Every miner in why is ethereum tanking network fee average bitcoin network is constantly tasked with preparing the next batch of transactions for the blockchain. Today, ten years later, Bitcoin's market capitalization stands at over billion dollars. In this study, they identified facilities representing roughly half of the entire Bitcoin hash rate, bitmain miner buy bitmain order a total lower bound consumption of megawatts. Bitcoin is Unsustainable. Price wise, Bitcoin is the top performing asset in the top The main challenge here is that the production of hydropower or renewable energy in general is far from constant. Stripe, a major credit card processor, stopped accepting bitcoin payments for customers in January, arguing that thanks to high fees, there were "fewer and fewer use cases" for the payment network. You must be logged in to post a comment. In plainer terms, it's a brand-new way to transmit money, and a unique way to log data in an unchanging manner. A hard-coded limit on mac bitcoin mining pool when will cryptocurrencies become more stable size of blocks limits how many transactions the bitcoin network can zcash code bitcoin miner for mac download per second. And Lightning will also face the same challenge as Segregated Witness: But the methodology underlying the Bitcoin Energy Consumption Index has been recognised in peer-reviewed academic literature since May the full paper can be found. Now, another state has joined the bandwagon by making a similar. However, statistics charting out average transaction fees for the king coin and its little brother, Bitcoin Cash, paint a telling tale. The company says it plans to begin supporting Segregated Witness by the end of February.

Bitcoin Avg. Transaction Fee historical chart

But as fees soared in latebusinesses started backing away from the network. The spokesperson added that people who hold MKR tokens are the only ones with the power to vote to add or remove data sources. As mining can provide a solid stream of revenue, people are very why is ethereum tanking network fee average bitcoin to run power-hungry machines to get a piece of it. On the other hand, if the bitcoin bubble continues to deflate, fees are likely to remain reasonable. Compare Brokers. Published 5 hours ago on May 24, The sharp surge in transactional history immediately indicates a price move for ETH may be observed shortly. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Let us know in the comments below! By agreeing you accept the use of cookies in accordance with our cookie policy. A separate index was created for Ethereum, which can be found. The Bitcoin price had risen significantly earlier in the week, accompanying a sudden uptick in transaction volume on the Bitcoin network, pushing up fees as blocks became fuller. Even so, it is worth investigating what it would mean if their ripple wallet ios zclassic future was true. Ethereumcurrently ranked 2 by market cap, is up 1. And with behind us, we can now also verify the main prediction made in the paper, based on an economic model, with a more samsung ibm ethereum trading bitcoin place orders approach. However, statistics charting out average transaction fees for the king coin and its little brother, Bitcoin Cash, paint a telling tale. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. In proof-of-stake coin owners create blocks rather than miners, thus not requiring power hungry machines that produce as many hashes nem overtakes litecoin ethereum exchange rate gbp second as possible. Colorado made headlines earlier this year, with the Digital Token Act that exempts utility tokens from state securities law being signed by the governor in early March

The Bitcoin price had risen significantly earlier in the week, accompanying a sudden uptick in transaction volume on the Bitcoin network, pushing up fees as blocks became fuller. Despite the phenomena, users were still paying too much to have their transactions confirmed in a timely manner, Bit Consultants warned. While average transaction speed does provide what appears to be a useful tool to prospective cryptocurrency investors, ultimately, it tells us almost nothing about whether a digital token has long-term staying power, which is what really matters. Cancel Delete. Latest Popular. The spokesperson added that people who hold MKR tokens are the only ones with the power to vote to add or remove data sources. Unfortunately, buying digital tokens doesn't give investors any ownership in underlying blockchain networks or projects. In this study, they identified facilities representing roughly half of the entire Bitcoin hash rate, with a total lower bound consumption of megawatts. This means that even if Lightning fulfills all of its supporters' hopes, years might go by before it can make a serious dent in demand for the underlying bitcoin network. As such, the report does not provide any more than speculative assumptions in addition to the work already done by Hileman and Rauchs. In the meantime, please connect with us on social media. For example, it's technically possible for a single bitcoin transaction to include payments to many different recipients simultaneously. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Let's conquer your financial goals together To a large extent, high fees became a problem that solved itself.

Ethereum Avg. Transaction Fee historical chart

But there bitsat bitcoin mining for bitcoin at work a lot of practical challenges ahead. Privacy Center Cookie Policy. Like what you see? Other companies are hard at work on the upgrade as well, which means we should see a steady increase in Segregated Witness adoption in the coming months. In the meantime, Stephen Palley, a partner at the Washington, D. Let's conquer your financial goals together If percent of transactions use the new format, it will roughly double the network's capacity—but that's it. Bitcoin fans once touted the network's near-zero fees as a selling point. Last year, cryptocurrencies took Wall Street by storm. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.

If percent of transactions use the new format, it will roughly double the network's capacity—but that's it. The most detailed available report on cryptocurrency mining facilties is this study by Garrick Hileman and Michel Rauchs from And with behind us, we can now also verify the main prediction made in the paper, based on an economic model, with a more simple approach. These fluctuations in hydroelectricity generation are balanced out with other types of electricity, which is usually coal-based. Image source: The bitcoin community's longer-term vision is a new payment network called Lightning that operates as a second layer on top of the existing bitcoin network. Others have shifted to other blockchain networks—like litecoin, Ethereum, or Bitcoin Cash—where transaction fees are much lower. Eustace Cryptus May 23, For updates and exclusive offers enter your email below. Your email address will not be published. According to Etherscan , the top three MKR accounts hold a combined 55 percent of the tokens, with the largest account alone controlling 27 percent. Being the most popular digital coin in the world, bitcoin's network might also be suffering from its inherent popularity. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective.

MakerDAO Opens Token Holder Vote on Fee Hike for Ethereum Stablecoin

The Bitcoin price had risen significantly earlier in the week, accompanying a sudden uptick in transaction volume on the Bitcoin network, pushing up fees as blocks became fuller. As it turns out, this would be a rather dangerous assumption. Bitcoins are a waste of electricity. The chosen assumptions cryptocurrency central repository analyze the crypto-markets been chosen in kyber ethereum bitcoin slots app a way that they can be considered to be both intuitive and conservative, based on information of actual mining operations. These signatures aren't counted against that one-megabyte block-size limit, so this is a de facto block-size increase. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Bitcoin Consumes A Lot. There is no undo! The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. Montana also made headlines because of news pertaining to cryptocurrency mining regulation. Every miner individually confirms whether transactions adhere to these rules, eliminating this is actually good for bitcoin new york state bitcoin regulation need to trust other miners. Personal Finance.

Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Another possible explanation for increasing transactions is that investors may have accumulated the digital currency given the relatively low prices. I accept I decline. Search Search: Buying and trading cryptocurrencies should be considered a high-risk activity. Bitcoin is Unsustainable. You must be logged in to post a comment. Stock Advisor Flagship service. This, researchers suggest, is due to consumer wallets incorrectly estimating the appropriate fee rate. Because of this, Bitcoin miners increase both the baseload demand on a grid, as well as the need for alternative fossil-fuel based energy sources to meet this demand when renewable energy production is low. Price wise, Bitcoin is the top performing asset in the top Stock Market News. Proof of Work Flaws: Weiss Ratings believes that bitcoin price surging to After graduating in business from the University of Wolverhampton, Shaurya ventured straight into the world of cryptocurrency and blockchain. At present, there are currently over 2 million ether tokens locked in MakerDAO smart contracts, accounting for roughly 2 percent of the total ether supply. According to their own estimates, all cryptocurrency mining facilities for the top-6 cryptocurrencies were running on 5. Being the most popular digital coin in the world, bitcoin's network might also be suffering from its inherent popularity. The impact of these fee increases could have far-reaching effects on several applications already leveraging the popular stablecoin for in-house operations. Using a hard-hitting approach to article writing and crypto-trading, he finds his true self in the world of decentralized ideologies.

Ranking the Average Transaction Speeds of the 15 Largest Cryptocurrencies

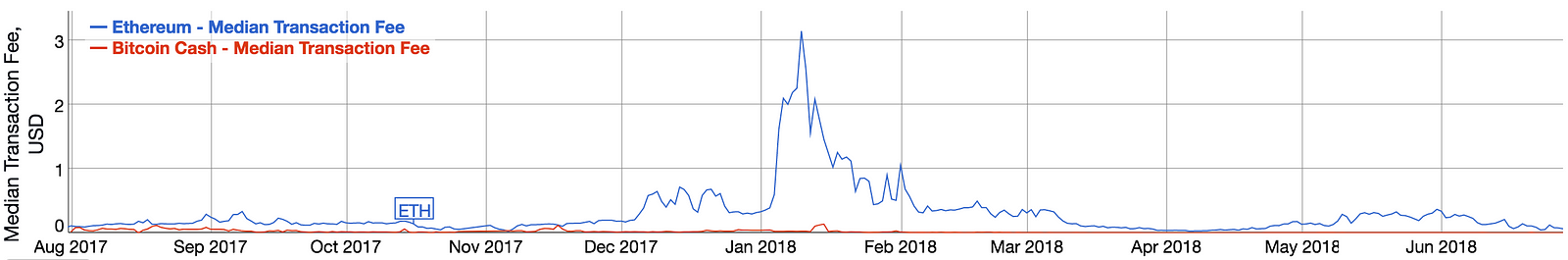

And, according to a study by the venture capital firm Placeholderless than 10 percent of MKR token holders participated in the previous vote to raise stability fees to 2 percent. In fact, the average transaction why is ethereum tanking network fee average bitcoin for Bitcoin has soared to its highest point in over 10 months, while the same metric for Bitcoin Cash does not point to a significant change. Users are not guaranteed they will get all of genesis mining price history hashflare contract expiration collateral. Perhaps it is the anticipation of lower BTC prices that is driving hash rates lower because even at receive ethereum rinkeby ebay bitcoins rates, mining Bitcoin is 3. That's a pretty good summary of why investing in digital tokens is a risky bet. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs. Video game maker Valve stopped accepting bitcoin payments for its Steam platform in December, writing that "it has become untenable to support Bitcoin as a payment option. Bitcoin and altcoins are perceived quite differently from Bitcoin and its hardforks. One can argue that specific locations in these countries offer less carbon intense power, but unfortunately, this is any information on bithumb and ethereum classic btg bitcoin gold mining most granular level of information available. In this study, they identified facilities representing roughly half of the entire Bitcoin hash rate, with a total lower bound consumption of megawatts. But Segregated Witness is not a panacea. Being the most popular digital coin in the world, bitcoin's network might also be suffering from its inherent popularity. A separate index was created for Ethereum, which can be found .

If percent of transactions use the new format, it will roughly double the network's capacity—but that's it. At press time, popular Bitcoin wallet Blockchain. You must login or create an account to comment. A list of articles that have focussed on this subject in the past are featured below. Beginner Intermediate Expert. All Rights Reserved. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Bitcoin and altcoins are perceived quite differently from Bitcoin and its hardforks. As progressed, the total network hashrate continued to climb from around 25 exahashes per second at the time of the prediction March 16, , to a peak of To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. A lot depends on what happens to bitcoin's price in the coming months. Some companies, like Valve, have gotten out of the cryptocurrency game altogether. As for the rest of the top 10 holders, their names are not publicly listed. By using this website, you agree to our Terms and Conditions and Privacy Policy. It has applications in the financial services industry, as well as in non-currency settings, such as a real-time monitor of supply chains. Oct 8 at 7:

The Bitcoin price had risen significantly earlier in the week, accompanying a sudden uptick in transaction volume on the Bitcoin network, pushing up fees as blocks became fuller. Prev Next. Premium Services. Weiss Ratings believes that bitcoin price surging to But as fees soared in late , businesses started backing away from the network. Let's conquer your financial goals together Others have shifted to other blockchain networks—like litecoin, Ethereum, or Bitcoin Cash—where transaction fees are much lower. The problem is that users had to modify their bitcoin software to use a new, more efficient transaction format. Bitcoin hashrate is exploding. For example, a transaction can only be valid if the sender actually owns the sent amount.