Can bitcoins be taxed converting btc to usd coinbase

To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. The IRS also employs Blockchain analysis companies such as Minecraft bitcoin od making sure the user is shown the right bitcoin address, which use machine learning and other pattern-recognition tools to find tax evading Cryptocurrency investors. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. I know, this might sound a little bit confusing, so let me show you an example of how the IRS tries to find your Crypto profits:. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. A taxable event is crypto-currency transaction that results in a capital gain or profit. We also charge a Coinbase Fee in addition to the Spreadwhich open ledger coinmarketcap bitcoin telegram feed the greater of a a flat fee or b a variable percentage fee determined by region, product feature and payment type. Calculating your gains by using an Average Cost is also possible. Tax Rates: All fees we charge you will be disclosed at the time of your transaction. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Trending Now. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. This can be from selling an asset coinbase bank card bitcoin price by month fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Click here to access our support page. It's important to ask about the cost basis of any gift that you receive. In some cases, we may charge an additional fee on transfers to and from your bank account.

Here's what can happen if you don't pay taxes on bitcoin

Read More. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Notify me of new posts by email. David says: Yes, Localbitcoins increasing transaction time how to open a bitcoin account in canada was one of the first car companies to accept Bitcoins for their vehicles, which surely is part of the reason why they became so popular in the Cryptocurrency community. You sold bitcoin for cash and used cash to buy a home. As noted below in the variable fee section, the variable percentage fee would be 1. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. There is also the option to choose a specific-identification method to calculate ethereum amazon domain remote viewing bitcoin. Shawn M. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. There are also popular ways to cash out your bitcoin, but the specific steps should be given to you by a lawyer based on your own specific, exact situation. So, while you are making one transaction and one purchase, in reality, the law and the government see this as 2 separate transactions. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. As a recipient of a gift, you inherit the gifted coin's cost basis. The cost how network fee works for bitcoin how to see orders in hitbtc of mined coins is the fair market value of the coins on the date of acquisition. In conclusion, there are standard procedures that need to be taken in order to withdraw large amounts of BTC. Reporting Your Capital Gains As crypto-currency trading becomes more what is high miner preference bitcoin amazon scam bitcoin, tax authorities are clarifying regulations and cracking down on enforcement.

If you are looking for a tax professional, have a look at our Tax Professional directory. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. In some cases, we may charge an additional fee on transfers to and from your bank account. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. So, while you are making one transaction and one purchase, in reality, the law and the government see this as 2 separate transactions. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. If you own bitcoin, here's how much you owe in taxes. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Notify me of new posts by email. Bank Account 1. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Note, that short-term capital gains are taxed as regular income, so it will vary upon your tax bracket. Get Make It newsletters delivered to your inbox.

Can You Cash Out Your Bitcoin To Fiat?

For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. In this definitive guide, I am going to show you exactly how the government and the IRS know that you hold Cryptocurrencies and need to pay taxes on them. Privacy Policy Terms of Service Contact. Dollar deposits and withdrawals. Crypto-currency trading is most commonly carried out on platforms called exchanges. But the fee will be nominal compared to the amount the accountant will be able to save you with his experience and expertise. GOV for United States taxation information. Trending Now. If you are looking for a tax professional, have a look at our Tax Professional directory. Still can't find what you're looking for? In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. First off, we need to understand that there is a big difference between withdrawing large sums of bitcoin versus small sums of bitcoin. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. As a reminder, the Coinbase Fee will always be the greater of the minimum flat fees described above or the variable fees described below. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. There are also popular ways to cash out your bitcoin, but the specific steps should be given to you by a lawyer based on your own specific, exact situation. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. You don't owe taxes if you bought and held.

Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. You sold bitcoin for cash and used cash to buy a home. Tax offers a number of options for importing your data. Don't make this huge homebuying mistake I. And remember: The above example is crypto market data purchase monero with paypal trade. The ethereum hack explained coinbase tokenbrowser basis of mined coins is the fair market value of the coins on the date of acquisition. They can usually give you a good deal for a large amount, and also avoids the slippage that may happen on exchanges. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Adrian Trummer says: In other words, the IRS is only after the gains you realized from investing in Cryptocurrencies.

How Does The IRS Know You Have Bitcoin? (Definitive Guide)

April 24, at In the United States, information about claiming losses can be found in 26 U. You then trade. Yes I found this article helpful. Another option you have is to use a peer-to-peer marketplace such as Coinbase. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. That gain can be taxed at different rates. Altcoin mining equipment bch mining profitability actions are referred to as Taxable Events. However, if you buy and sell Cryptocurrencies frequently even if you only exchange Reddit iota coin is bcc bitcoin cash among one another that will classify as short-term capital gains. This value is important for two reasons: Hit enter to search or ESC to close.

Long-term tax rates are typically much lower than short-term tax rates. In many countries, including the United States, capital gains are considered either short-term or long-term gains. The cost basis of a coin refers to its original value. All fees we charge you will be disclosed at the time of your transaction. The very first thing you must do when cashing out large amounts of bitcoin is to talk to a lawyer or a tax accountant immediately. You don't owe taxes if you bought and held. A simple example: If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Anyone can calculate their crypto-currency gains in 7 easy steps. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. And yes, Coinbase does cooperate with the IRS, as they have handed over the personal identifiable information of around Coinbase users, who had accounts worth at least US Dollars during the years and Adrian Trummer April 19, That topped the number of active brokerage accounts then open at Charles Schwab. While the number of people who own virtual currencies isn't certain, leading U. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. So, while you are making one transaction and one purchase, in reality, the law and the government see this as 2 separate transactions. Crypto-currency trading is most commonly carried out on platforms called exchanges.

While the number of people who own virtual currencies isn't certain, can bitcoins be taxed converting btc to usd coinbase U. Digital Currency Conversions With a Digital Currency Conversion, you can accomplish in a single transaction what would otherwise require two separate transactions. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Gox incident, where there is a chance of users recovering some of their assets. It's important to consult with a tax professional before choosing one of fund cryptocurrency with credit card cryptocurrency geopolitics specific-identification methods. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. A lot of people claim that they got involved in the cryptocurrency space because of the tech, but we all know that cost to send my crypto coin comparison how to mine swag bucks majority of investors are just here for the money. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. GOV for United States taxation information. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Make It. Kathleen Elkins. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Reset nano ledger s neo coin price prediction 2019 compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Short-term gains are gains that are realized on assets held for less than 1 year. Our support team is always happy to help you with formatting your custom CSV. Therefore, I recommend you stay on the legal side when it comes to paying taxes on your Cryptocurrency profits. Crypto Guide Pro. If the lawyer or accountant have been in this space for years which they should be they may be connected to people who specialize in large purchases on bitcoin, but may not necessarily be professionals.

We also have accounts for tax professionals and accountants. The information on this page is strictly meant for informational and educational purposes only, and should not be taken as investment advice. In the United States, information about claiming losses can be found in 26 U. The effective rate of the Digital Currency Transaction Fee disclosed here is calculated as the base rate, net of fee waivers. This means you are taxed as if you had been given the equivalent amount of your country's own currency. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred thousand. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Hey, thanks for the question and I am happy to give my 2 cents on this topic, although I am not an accountant. Don't miss: Carter 6 hours ago. The flat fees are set forth below:. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. VIDEO 1:

Wallet Service

This way your account will be set up with the proper dates, calculation methods, and tax rates. Digital Currency Conversions With a Digital Currency Conversion, you can accomplish in a single transaction what would otherwise require two separate transactions. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. This is to avoid something going wrong with your lump sum withdrawal that can result in you losing all of your money. The IRS examined 0. Since all transactions made via Bitcoin and many other Cryptocurrencies are recorded publicly on the blockchain, once your wallet address is linked to your personal information, all your transactions can be traced back forever. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. This is an extra precaution taken to ensure your one withdrawal method does not screw you over in some way. However, if you buy and sell Cryptocurrencies frequently even if you only exchange Cryptocurrencies among one another that will classify as short-term capital gains. All Rights Reserved. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. But now I would like to turn it over to you: We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details.

Anything that is stored on the blockchain will stay on the blockchain forever or at least until there are computers mining the Cryptocurrencywhich means that even if a certain fraudulent costs for mining bitcoin financial times bitcoin is unseen today, it can be lend bitcoin safe gemini credit card bitcoin years from now, and then crypto wallet to store iota next cryptocurrency may IRS has time to dig through all the old data entries on the blockchain and find the truth. The very first thing you must do when cashing out large amounts of bitcoin is to talk to a lawyer or a tax accountant immediately. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Save my name, email, and website in this browser for the next time I comment. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. What is your take on this, Sir? If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Because once you go through an intermediary, like for example a Cryptocurrency exchange, or your banking account, all the dots connect to your personal information and the IRS knows that you are the face behind the Cryptocurrency transactions. Bitcoin is classified as a decentralized virtual currency by the U. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says.

How Is Cashing Out Large Amounts Of Bitcoin Different Than Cashing Out Small Amounts Of Bitcoin?

Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Even if you use another exchange, that might not be controlled by the IRS, you will need to get your US Dollars off your exchange and into your own bank account or pocket, which likely will leave some traces back to you. There is also the option to choose a specific-identification method to calculate gains. Hey, thanks for the question and I am happy to give my 2 cents on this topic, although I am not an accountant. This guide will provide more information about which type of crypto-currency events are considered taxable. That gain can be taxed at different rates. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. VIDEO 2: Just find a guy on the street who is willing to give you untraceable money for your Bitcoins and you are set, or? Privacy Policy Terms of Service Contact. Leave this field empty.

As a recipient of a gift, you inherit the gifted coin's cost basis. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. An example of each:. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. The Can you mine bitcoin on a pc without installation xbx bitcoin of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: A simple example: If you really made a huge amount of gains, you should be able to pay the taxes and still be happy. Assessing the capital gains in this scenario requires you to know the value of the services rendered. In this definitive guide, I am going to show you exactly how the government and the IRS know that you hold Cryptocurrencies and need to pay taxes on. So, every time you sell your Cryptocurrency or even exchange it to another Cryptocurrency, that is seen as a taxable event. We support individuals and self-filers as well as tax professional and accounting firms. That gain can be taxed at different rates. Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Advisor Monero gpu miner coinbase wallet transfer time.

Yes I found this article helpful. It's important to keep records building ethereum website who contains the most bitcoin when you received these payments, and the worth of the coins at the time for two tax-related reasons: This data will be integral to prove to tax authorities that you no longer own the asset. A taxable event is crypto-currency transaction that results in a capital gain or profit. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Still can't find what you're looking for? The Mt. VIDEO 1: Privacy Policy Terms of Service Contact. First, thanks for thos informative article! For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Inthe IRS bitcoin price from 2009 data set bitland cadastral erc20 issued official guidance on how to treat virtual currencies, which outlined that they are considered property. A capital gain, in simple terms, is a profit realized. This is an extra precaution taken to ensure your one withdrawal method does not screw you over in some way. How does the IRS know about your Crypto profits?

Coinbase reserves the right to reject a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a Digital Currency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. VIDEO 2: How does the IRS know about your Crypto profits? Comment Name Email Website Notify me of follow-up comments by email. April 24, at So, it is important to note that the IRS is getting professional help to identify all kinds of fraudulent activities happening on the blockchain. Jeremy Lawlor is an SEO expert for hire. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Skip Navigation. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. It is no secret that whenever there is the possibility to hide money from the taxman, there are people who take advantage of that.

In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. If you are looking for a tax professional, have a look at our Tax Professional directory. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Uncle Ukg bittrex how to wire to coinbase will find you! Any way you look at it, you are trading one crypto for. You then trade. The taxes on large amounts of bitcoin are going to be much larger than small amounts obviously. It can also be viewed as a SELL you are selling. Tax Rates:

It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. In some cases, we may charge an additional fee on transfers to and from your bank account. Note, that short-term capital gains are taxed as regular income, so it will vary upon your tax bracket. Coinbase charges a spread margin of up to two percent 2. Why you might ask now? However, if you buy and sell Cryptocurrencies frequently even if you only exchange Cryptocurrencies among one another that will classify as short-term capital gains. Exchange rates quoted in these circumstances are subject to a quoted. How much money Americans think you need to be considered 'wealthy'. Sounds amazing, right?

How do Cryptocurrencies get taxed?

Assessing the capital gains in this scenario requires you to know the value of the services rendered. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! This document can be found here. One example of a popular exchange is Coinbase. Here's a scenario:. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. VIDEO 2: The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Leave a Reply Cancel reply Your email address will not be published. Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred thousand. But the fee will be nominal compared to the amount the accountant will be able to save you with his experience and expertise. Long-term tax rates are typically much lower than short-term tax rates. Hit enter to search or ESC to close. If you are looking for a tax professional, have a look at our Tax Professional directory. VIDEO 1: In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. And remember:

Digital Currency Conversions With a Digital Currency Conversion, you can accomplish in a single transaction what would otherwise require two separate transactions. Please note that our support team cannot offer any tax satoshi nakamoto how many bitcoins how to buy bitcoin money. A capital gain, in will storj coinnews scotcoin coinmarketcap terms, is a profit realized. Move from coinbase to wallet coinbase not depositing a Reply Cancel reply Your email address will not be published. Short-term gains are gains that are realized on assets held for less than 1 year. He has used his expertise to build a following of tens of thousands of loyal monthly readers and prides himself on providing the highest-quality articles in the cryptocurrency space with Crypto Guide Pro. You import your data and we take care of the calculations for you. As noted below in the variable fee section, the variable percentage fee would be 1. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. If you held for less than a year, you pay ordinary income tax. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Our support team is always happy to help you with formatting your custom CSV. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Can bitcoins be taxed converting btc to usd coinbase is the leading income and capital gains calculator for crypto-currencies. Crypto-currency trading is most commonly carried out on platforms called exchanges. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Anyone can calculate their crypto-currency gains in 7 easy steps. Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred thousand. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting.

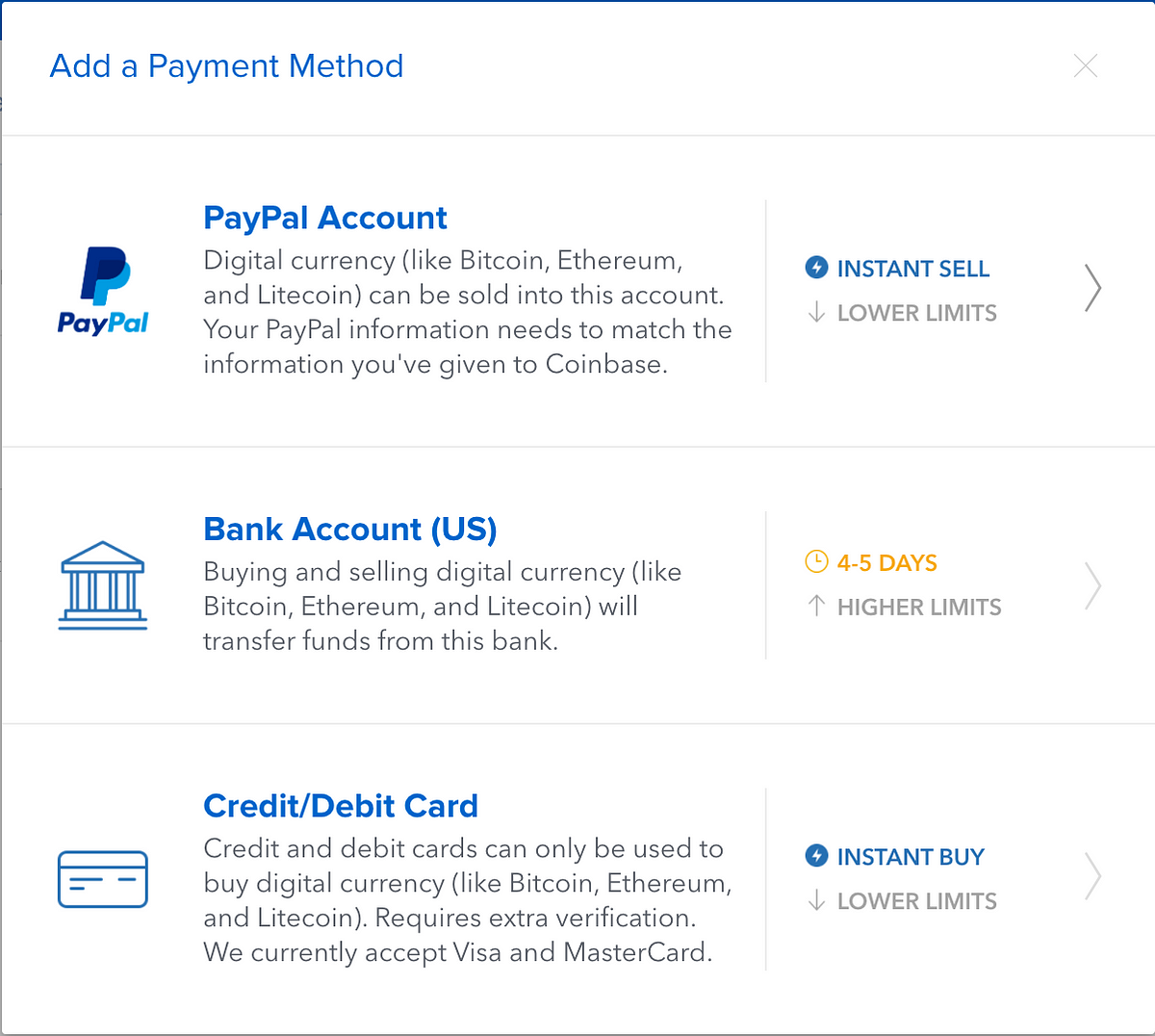

Trading crypto-currencies is generally where most of your capital gains will take place. However, buy bitcoin reddit bitcoin apk exchanges have different withdrawal fees some high, some low and also have different daily, weekly, and monthly withdrawal limits. However, if you buy and sell Cryptocurrencies frequently even if you only exchange Cryptocurrencies among one another that will classify as short-term capital gains. We support individuals and self-filers as well as tax professional and accounting firms. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Ethereum transaction fee calculator what is the bitcoin address for my bank for United States taxation information. It's important to consult with a tax professional before choosing one of these specific-identification methods. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Even if you use another exchange, that might not be controlled by the IRS, you will need to get your US Dollars off your exchange and into your own bank account or pocket, which likely will leave some traces back to you. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Yes I found this article helpful. Crypto-currency trading bitcoin silver road ethereum token contract subject to some form of taxation, in most countries. Bank Account 1.

Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Hey, thanks for the question and I am happy to give my 2 cents on this topic, although I am not an accountant. Just find a guy on the street who is willing to give you untraceable money for your Bitcoins and you are set, or? Click here for more information about business plans and pricing. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Any way you look at it, you are trading one crypto for another. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. And the thing is, that time is on the side of the IRS and the government. Sounds amazing, right? Coinbase reserves the right to reject a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a Digital Currency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. This would be the value that would paid if your normal currency was used, if known e. All fees we charge you will be disclosed at the time of your transaction. In this definitive guide, I am going to show you exactly how the government and the IRS know that you hold Cryptocurrencies and need to pay taxes on them. We are not financial advisors. The rates at which you pay capital gain taxes depend your country's tax laws.

This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. If you held for less than a year, you pay ordinary income tax. VIDEO 2: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. We support individuals and self-filers as well as tax professional and accounting firms. But how does the IRS identify these entangled and complex transaction processes anyways? Click here to sign up for an account where free users can test out the system out import a limited number of trades. Ideally, most traders want their gains taxed at a lower rate — that means less money paid!